FINALLY FUND YOUR STARTUP

or BUSINESS GROWTH

LOCATE, PITCH, and CLOSE THE RIGHT

INVESTORS and COLLABORATIVE PARTNERS

My tactics have secured millions in venture capital, angel investments, and sponsorship money.

WATCH: The Strategies I Wish I'd Known

And Learned The Hard Way

You don't have time to waste.

Hi, I'm Suzanne Duret.

As a serial entrepreneur I've made all of the mistakes for you. I did things my way and broke many "traditional" rules. It resulted in capturing funding for every single venture I've pursued capital for.

Tony Robbins

"When I first met Suzanne Duret, I was impressed by her unique success story and even more so by her continuing desire to help others achieve their goals, as well."

(Excerpt from Tony's foreword to Suzanne's book, Inventing For Wealth, published mid-90s.)

Mentor at Tampa Bay Wave

Florida's #1 Startup Accelerator

Inside you'll find fast-paced video lessons and more.

Here’s how to quickly go from stuck to strategic...

Choose the Right Funding Source & Get Clear on Your Why

Stop chasing the wrong money. Discover exactly what kind of funding is right for you based on your business stage, long-term vision, and risk profile. This is how you avoid wasted time, bad investor fits, and dead-end capital.

⏱ 2 quick lessons | 38 minutes

Position Yourself as a No-Brainer Investment

If investors aren’t saying yes, it’s likely a positioning problem. Learn how to lower perceived risk, build proof with the media and advisory boards, and use credibility levers like accelerators to get investor attention before you even pitch.

⏱ 4 quick lessons | 106 minutes

Understand the Investor Before You Ever Reach Out

Pitching too early or blindly = blown opportunities. You’ll learn how to research investors, structure your capital raise strategically, and anticipate their toughest questions. Walk into every meeting with confidence and clarity.

⏱ 3 quick lessons | 65 minutes

Master Influence, Persuasion & Powerful Connection

Get investors to lean in and say “Tell me more.” Learn how to communicate with confidence, use persuasive storytelling, and build deep rapport fast. Plus, you’ll navigate common gender dynamics and find champions who open doors for you.

⏱ 4 quick lessons | 82 minutes

Pitching to Win – Own the Room, Control the Flow

No more rambling pitches or forgettable decks. Master your elevator pitch, build a standout deck, use emotional storytelling to stay memorable, and learn how to stay in control of every investor interaction. You’ll position yourself as the prize, not the one chasing.

⏱ 5 quick lessons | 78 minutes

What Really Happens Behind the Scenes

This is what most entrepreneurs never get to see. Learn how deals actually get done. From identifying aligned investors and passing “tests,” to using strategic pushback psychology - this is your roadmap for navigating behind-the-scenes moments that make or break your raise.

⏱ 4 quick lessons | 72 minutes

Creative Funding That Doesn’t Dilute Your Power

Bootstrapping doesn’t mean bootstrapped. Discover creative ways to raise capital without giving up equity - like pitch competitions, grants, sponsorships, and crowdfunding strategies. This is how you build momentum and maintain control as you grow.

⏱ 3 quick lessons | 73 minutes

Total Value:

$10K? 20K? $50K?

These are the exact strategies that have

raised millions in venture capital,

angel investments, and corporate sponsorships.

Now they’re yours.

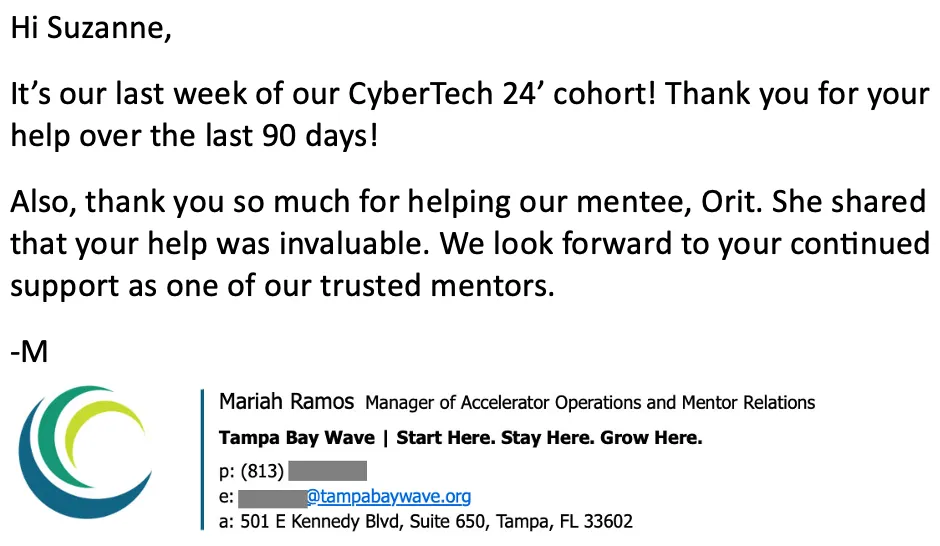

BUY NOW AND GET THESE BONUS ITEMS FOR FREE

Lifetime Access... anytime we update with new content or bonuses, you’ll be notified via email and get complimentary access!

Plus You Get...

Investor Pitch Deck Creation Tips

Decision Making Exercise

Two Pre-Done Pitch Deck Templates

Elevator Pitch Template & Samples

50 Mind-Numbing Investor Questions

Investor Profile Questionnaire

Legal Document Library

Total Bonus Value: $12,100

Today’s Limited-Time Investment

(before the price increases or bonuses expire)

$1,997 $555

One $555 strategic payment could unlock millions in funding.

Enroll now for lifetime access to the course, bonuses, and updates.

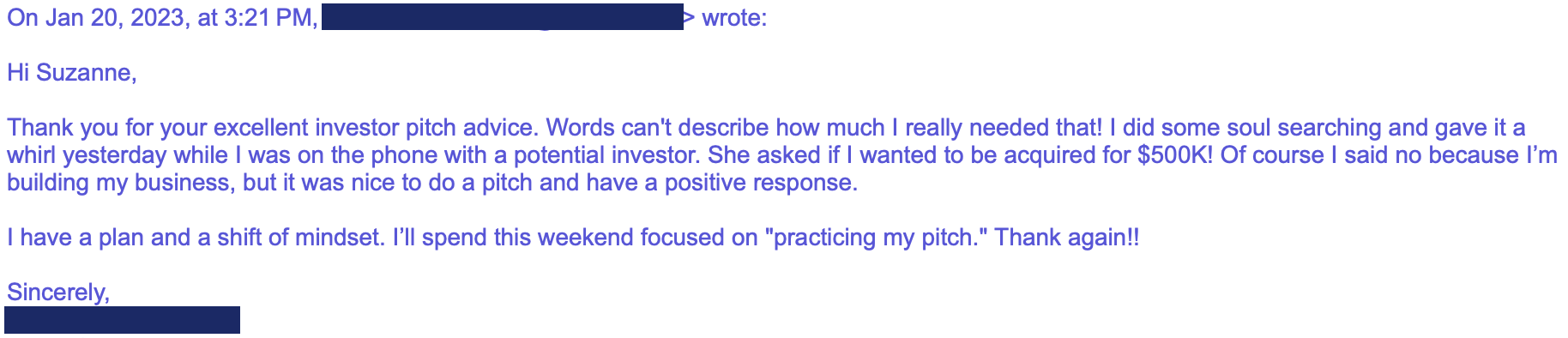

FROM THE TRENCHES

TO FUNDRAISING TRIUMPH

Imagine This. You have an idea, a vision, and the drive to make it happen, but one major hurdle stands in your way... capital.

For most, this would be the end of the story. But not for me - and it doesn’t have to be for you either.

I went from being a secretary to creating high-paying opportunities for myself. I've raised millions of dollars and sold the very first company to a division of Kimberly-Clark, which is a Fortune 500 giant.

Over the years I’ve raised venture capital, angel funding, and even sponsorship money, all while learning through hands-on experiences.

I’ve been in the trenches and made every mistake imaginable before finding success.

My first attempt took a very a long time, two years. I had no clue. Venture capitalists made me jump through impossible hoops. I took on the challenges and the lessons. And then the funding finally came.

After figuring out what actually works, I launched a new startup. That time I pitched angel investors and raised $1.4 million from total strangers across the country.

I closed deals within days. By then I knew what I was doing and how to locate and pitch investors for the win.

I've done other capital raises of my own, as well as helped clients with theirs. I've even closed corporate sponsorships ranging from $35K - $100K, which is a great way to fund a project or event.

And now, I’m sharing the exact strategies with you in my training, Tactical Capital Raising.

This isn’t some theoretical course taught by someone who’s never done it. I’ve secured funding in boardrooms, as well as in my own living room.

Whether it’s venture capital, angel funding, or corporate sponsorships, I’ve been there, done that, and mastered the process. And now I'd like to help you do the same. ~Suzanne Duret

Who Is This For?

Entrepreneurs and founders looking to scale their existing business but after many attempts still struggle to secure the capital needed.

Startups in any sector (tech, health, consumer products, etc.) that are ready to take their growth to the next level but need guidance in attracting the right investors.

Aspiring inventors and entrepreneurs who have a great idea or early-stage business but don’t know how to approach the fundraising process.

Women entrepreneurs seeking to break barriers in capital raising by leveraging proven techniques to secure funding, even in male-dominated industries.

People overwhelmed or confused with finding the right investors, investor pitches, and funding options.

Non-tech founders who aren't a fit for venture capital and want to learn how to approach angel investors with confidence and a winning strategy.

Social impact or purpose-driven ventures that need capital but founders face challenges when pitching their mission to investors.

Anyone ready to attract and close backers quickly, confidently, and with strategies that have already helped other entrepreneurs raise millions.

Do I need prior experience raising capital?

No prior experience is necessary. Suzanne had none when she started out. This training is suitable for both beginners and those who have attempted to raise capital before but want a more effective, proven strategy.

Do I need connections to investors before taking this training?

No, the training will teach you how to find and network with the right investors—even if you’re starting from scratch. You’ll learn how to build relationships and position yourself to attract investor interest, regardless of your current network. In fact, you'll learn to bypass judgment on people you think can't invest or open the door to an investor. Suzanne raised $1.4 million because of that tactic, and she discusses it in one of the lessons.

What if I’m not good at pitching or speaking to investors?

The training includes detailed sections on crafting a compelling pitch and how to confidently communicate with investors. You’ll get tools and techniques that simplify the process, even if you don’t feel like a natural salesperson.

How is this training different from other capital raising programs?

Finding investors is one thing. Getting in front of them is another thing. And closing them is another thing entirely. Most programs and platforms teach the same things, or what we call the "traditional" approaches. THIS training is fast-paced and focused on practical strategies, many of which are quite creative and not taught elsewhere.

Suzanne Duret has real-world experience raising millions of dollars, so you’ll get insights that aren’t found in typical academic or theory-based programs. Suzanne shares tactics based upon what brought her success, and she also shares personal stories of actual experiences that you can now learn from.

How do I access the training videos and bonus materials?

Once you enroll, you’ll be emailed a link with instant access to the training materials, which you can view on any device. You’ll have lifetime access to all current content and updates with new content.

Do I need a business plan before taking this training?

While having a business plan can be helpful, it’s not required to do the training. You'll be guided through the key components investors look for, including how to structure your business for funding success, whether or not you have a formal business plan in place. The training will help you determine what you need for the type of funding approach you decide to go for.

Does the training include live coaching or mentoring?

The core training is self-paced, but we offer optional coaching packages for those who want more personalized guidance after completing the course. Additional information is located inside the training portal.

How can I apply what I learn to my specific industry?

The principles taught in this training are universal and can be applied to any industry. Whether you’re in tech, retail, health, a service-based business, e-commerce, etc. The strategies for attracting and closing investors will work for any niche with some slight relevant customization.

Will this training help me if I’ve been rejected by investors before?

Yes! If you’ve struggled to attract or close investors in the past, this training will help you identify what went wrong, refine your pitch, and approach new investors with a stronger strategy.

How do I know if my business or invention is ready to raise capital?

If you have a validated business idea or are generating revenue but need capital to grow, you’re likely ready to start raising funds. The training will help you determine your business’s funding readiness and funding options, and guide you through the steps to prepare for investor outreach.

What about the Legal Document Library in the Bonus section?

The library includes 9 documents crafted by actual attorneys, complete with attorney notes to help you understand the content (which is the main purpose for providing them). The documents serve as a valuable resource to help entrepreneurs navigate the complexities of securing and managing investments. Furthermore, the documents can potentially help you save on legal fees by jump-starting documents for you to fill out and then pay to have reviewed. Keep in mind that every state has its own set of rules and regulations that may require related customization of the documents.

Where can I learn more about Suzanne?

LinkedIn Profile: https://www.linkedin.com/in/suzanneduret/

What is your refund policy?

Our training materials and resources were designed to help you get the outcome you want. Results can happen when you stay open to new ways of approaching something and to seeing things through. The only way to fail is in giving up, and we don't support that, which is why we don't offer refunds. Furthermore, the digital nature of our content prohibits us from offering refunds under any circumstances. Therefore be certain that this training and the bonus items are right for you. Your outcome will be determined by your commitment to go all in on learning and taking action. We're cheering you on!